The 5% Deposit Scheme: Everything you need to know.

On October 1st 2025 the First Home Guarantee Scheme, which helped thousands of Australians to buy their first home without having the preferred 20% deposit and avoiding the dreaded Lender’s Mortgage Insurance.

The Federal Government has refreshed the scheme with a new name, new rules and even more reasons to check it out if you’re buying your first home.

A revamp? OK, what’s actually changed then?

Good question; here’s what’s new under the updated scheme: :

The name

It’s now called Australian Government 5% Deposit Scheme. While the name has changed, the goal remains the same.

No income cap

Previously, if you earned above a certain level, you weren’t eligible. That’s now been scrapped — so here’s now no limit on what you can earn.

No limit on places

Before, spots under the scheme were limited and at times filled quite quickly. Now? No limit — it’s open to everyone who qualifies.

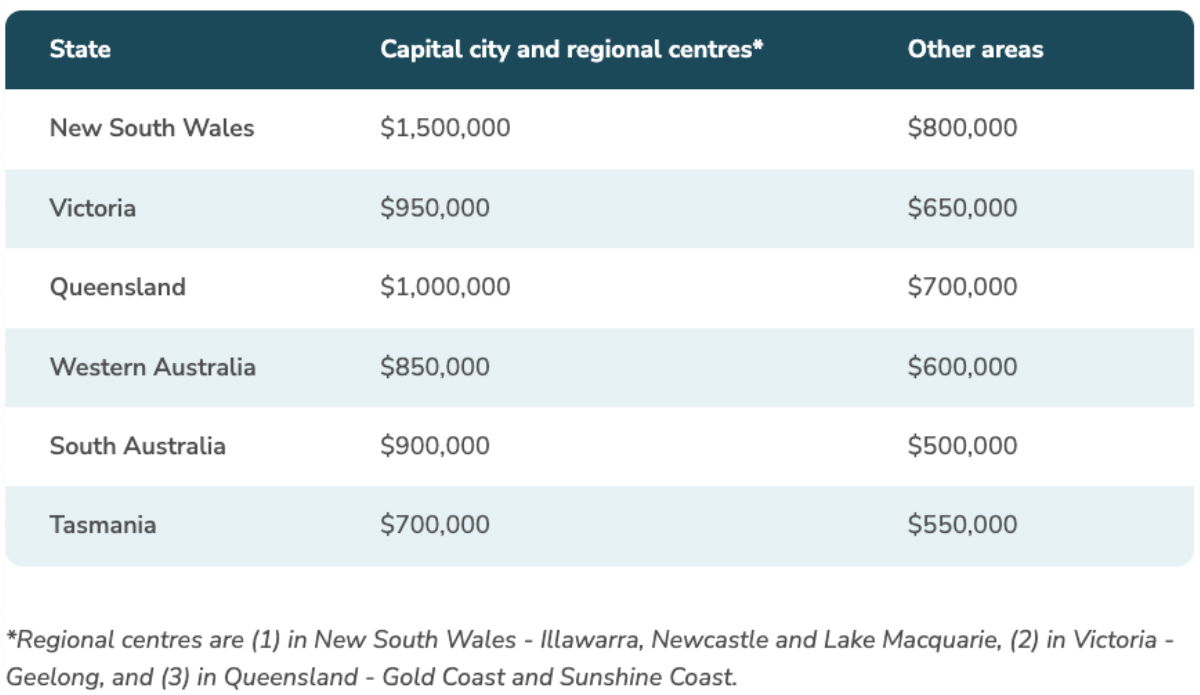

Higher property price caps

You can now buy more expensive homes under the scheme — but price limits do vary by state and territory, so check the table below.

Less paperwork

The process is now simpler and faster, with fewer forms and less documentation needed from you.

Right…and what hasn’t changed?

Good spot! There are a bunch of things that haven’t changed:

It’s for first home buyers only

You must be buying your very first property in Australia.

You have to live in the home

It must be your principal place of residence — not an investment.

You still need a 5% deposit - at least - AND any purchase costs

The bank will only lend you up to 95% of the property’s value, so you’ll need to cover any bank & government fees (e.g. Stamp & Transfer Duty), as well as legal fees.

The Government guarantees part of your loan

Which is how you’re able to avoid paying Lenders Mortgage Insurance (LMI) — which can save you tens of thousands of dollars.

It’s available through participating lenders

Not every bank or lender offers it — you’ll need to apply through HoLo with one that does.

How do I learn more and check if I qualify?

Download this information guide. We can also walk you through the scheme, check your eligibility, and help you apply through the right lender — all in plain English; no bank jargon.

Contact us or complete the form below to get started.

Tags: